new orleans sales tax 2020

This two day 2020 Louisiana Sales Tax Holiday is definitely a helping hand. TaxFee Description Rate Effective Date Required Filing Tax Form.

4417 St Charles Ave Unit 4417 New Orleans La 70115 Realtor Com

675 Occupancy Tax - Eff.

. Here is what you need to know. Gail Cole Oct 15 2020. For tax rates in other cities see Louisiana sales taxes by city and county.

Louisiana has recent rate changes Tue Oct 01 2019. Orleans NE Sales Tax Rate The current total local sales tax rate in Orleans NE is 5500. Occupancy and Sales Taxes.

92020 total of 1175. Nearby Recently Sold Homes. March and April 2020 Sales Tax Periods The March and April 2020 sales tax returns1 and payments were due April 20 and May 20 2020 respectively.

You can print a 945 sales tax table here. NEW ORLEANS - Councilmember Helena Moreno has filed an ordinance to exempt diapers and feminine hygiene products from local sales taxes lowering the costs for these essential items during the pandemic-induced economic downturnUnlike many other essential health products that are available tax-free feminine health products like tampons and diapers. The 2018 United States Supreme Court decision in South Dakota v.

Occupancy Privilege Tax Eff. The New Orleans sales tax rate is 0. Please contact the parish for a copy of the sales use tax.

The online auction will be active Tuesday July 21 through Thursday July 23 2020. The sales tax that expired at the end of last. The Orleans Parish sales tax rate is.

NEW ORLEANS Today the City of New Orleans announced it will hold an online tax certificate sale as part of its continuing efforts to collect delinquent real estate taxes. With local taxes the total sales tax rate is between 4450 and 11450. The December 2020 total local sales tax rate was also 9450.

Members of the New Orleans City Council voted Thursday to place a ballot initiative on the April 24 election ballot to reinstate a quarter cent sales tax to pay for supplemental police patrols in the French Quarter. The New Orleans sales tax rate is. The City is actively working to provide support for all New Orleanians from families to businesses to aid them in.

In addition the City will extend the renewal period for ABOs up to 30 days without penalty. This is the total of state parish and city sales tax rates. The Louisiana sales tax rate is currently.

1175 675 5 912020. The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7.

Here is what you need. What is the sales tax rate in Orleans Parish. Average Sales Tax With Local.

Diapers and feminine hygiene products are now exempt from half of the local sales tax in New Orleans Louisiana. The state sales tax rate in Louisiana is 4450. Effective Starting September 1 2020 to Present 5 Sales Tax - Eff.

To qualify for penalty. A similar tax was approved by voters in 2015 and expired at the end of 2020. Sales Tax Rates Louisiana information registration support.

This is the total of state and parish sales tax rates. Select the Louisiana city from the list of popular cities below to see its current sales tax rate. New Orleans Property Tax Propositions December 5 2020 analyzes three propositions to replace several City of New Orleans property taxes that expire at the end of 2021.

OVERVIEW On the Ballot. The average cumulative sales tax rate in New Orleans Louisiana is 943. Did South Dakota v.

Effective July 1 2022 diapers and feminine hygiene products are also exempt from state sales tax in Louisiana. The December 2020 total local sales tax rate was also 5500. No notices at this time.

1101 Patterson Rd New Orleans LA 70114. The replacement taxes would have the same combined rate of 582 mills as the existing taxes. Department of Finance Bureau of Revenue - Sales Tax 1300 Perdido St RM 1W15 New Orleans LA 70112.

And Occupancy Fees 500 or 1200RoomNight Eff. Within New Orleans there are around 51 zip codes with the most populous zip code being 70122. Mayor LaToya Cantrell today announced that response to the COVID-19 outbreak the City of New Orleans is waiving fines fees interest and penalties on sales tax payments due to the City for 60 days.

Nearby homes similar to 2020 Ptolemy St have recently sold between 175K to 567K at an average of 205 per square foot. There are a total of 263 local tax jurisdictions across the state collecting an average local tax of 5076. There is no applicable city tax or special tax.

However they continue to be subject to a 25 city sales tax and the 445 Louisiana state sales tax rate. New Orleans LA Sales Tax Rate The current total local sales tax rate in New Orleans LA is 9450. The Parish sales tax rate is.

New Orleans LA Sales Tax Rate The current total local sales tax rate in New Orleans LA is 9450. SOLD MAR 18 2022. The minimum combined 2022 sales tax rate for New Orleans Louisiana is.

Louisiana Sales Tax Holiday Details. 10 sales tax. New Orleans LA 70112.

According to the Louisiana Department of Revenue the first 2500 of most consumer purchases from the 445 state sales tax are exempt The Louisiana Sales Tax 2020 holiday will apply to many in-store purchases as well as transactions. New Orleans officials kept City Halls budget in the black with deep spending reductions in 2020 after projected revenue sank almost 40. City of New Orleans Website.

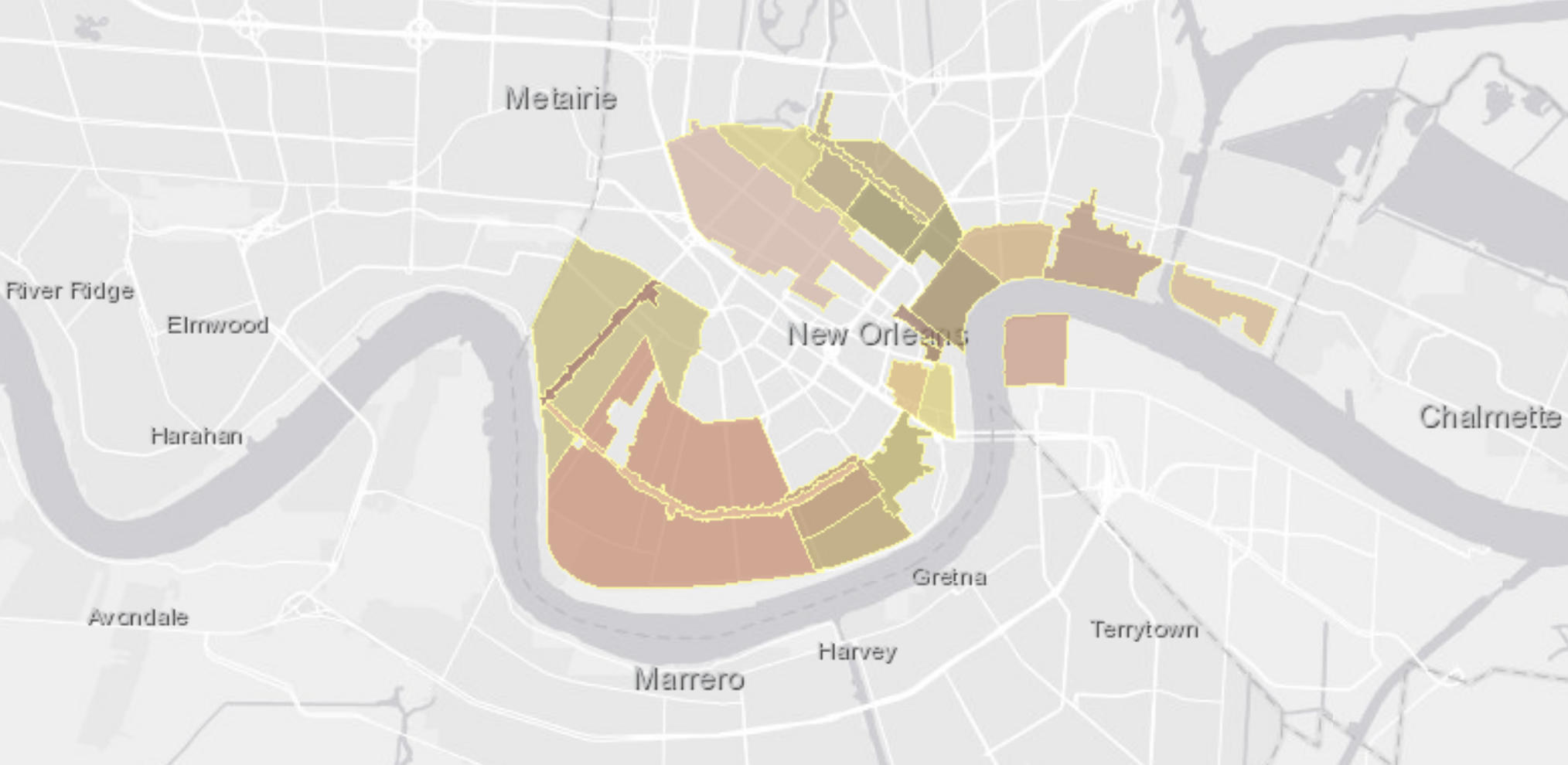

New Orleans has parts of it located within Jefferson Parish and Orleans Parish. The Louisiana state sales tax rate is currently. Ad New State Sales Tax Registration.

However the propositions would change the tax dedications. SOLD JUN 2 2022. General Sales and Use Tax Report Effective 1012020 Short Term Rentals Tax Report Last Updated 10202020 Hotel-Motel Tax Report.

Due to the ongoing public health emergency and in an effort provide relief to businesses in Louisiana the Department of Revenue will grant automatic penalty relief to taxpayers under certain conditions. What is the sales tax rate in New Orleans Louisiana. This includes the rates on the state county city and special levels.

2020 Louisiana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The minimum combined 2022 sales tax rate for Orleans Parish Louisiana is. The Parish sales tax rate is 5.

However they continue to be subject to a 25 city sales tax and the 445 Louisiana state sales tax rate. 499000 Last Sold Price. The sales tax holiday helps residents save a little bit of money on certain purchases.

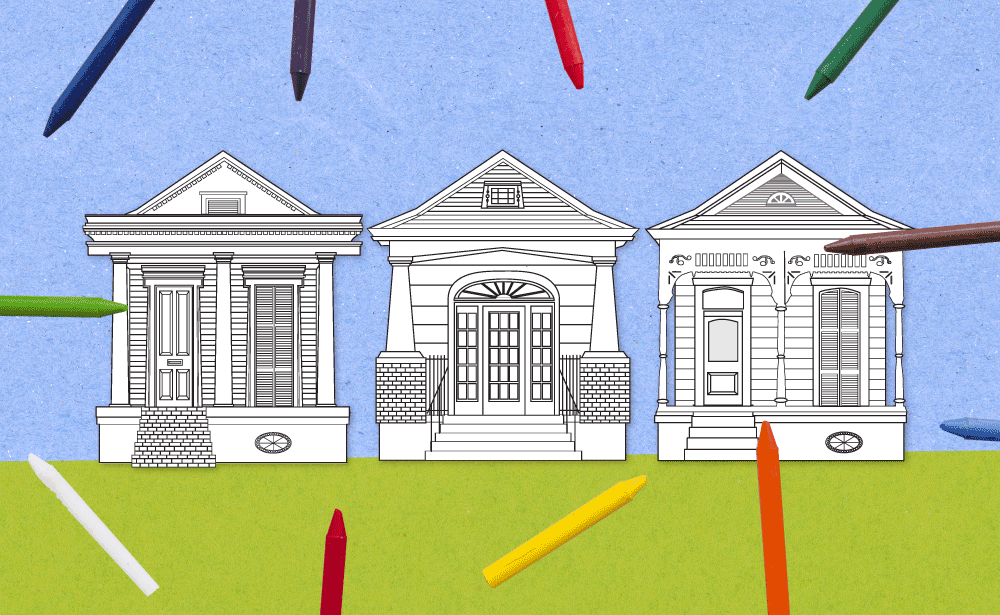

Understanding Historic Districts In New Orleans

New Orleans The Transport Politic

4308 Laurel St Unit 4308 New Orleans La 70115 Realtor Com

Economy In New Orleans Louisiana

New Orleans Pelicans On The Forbes Nba Team Valuations List

Let S Explore Historic New Orleans Fun Free Activity Sheets For Kids Preservation Resource Center Of New Orleans

4 Day New Orleans Itinerary The Blonde Abroad

New Orleans Louisiana S Sales Tax Rate Is 9 45

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

New Orleans Leaders Workers Fear Prospect Of Prolonged Tourism Slump On Regional Economy Business News Nola Com

New Orleans City Council Approves Somber Budget For 2021 The Lens

Infographic New Orleans Travel Surges

4036 Saint Charles Ave New Orleans La 70115 Realtor Com

Buyers Pay Steep Price For Homes In This New Orleans Neighborhood New Orleans Citybusiness