sacramento county tax rate 2021

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The 2018 United States Supreme Court decision in South Dakota v.

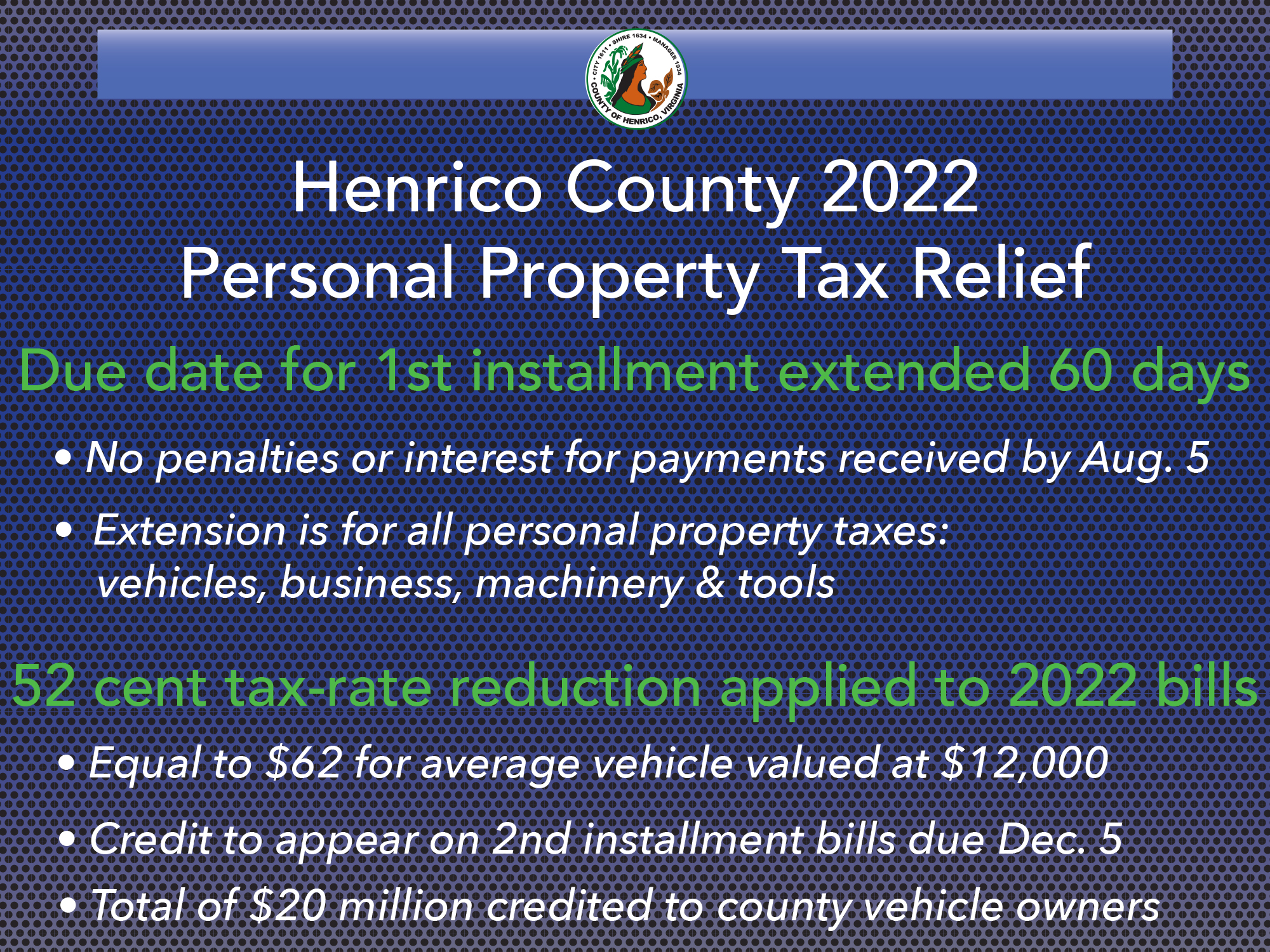

Henrico Proposes Personal Property Tax Relief To Offset Rising Vehicle Values Henrico County Virginia

The assessment roll reflects the total gross assessed value of locally assessed real business and personal property in Sacramento County as of January 1 2021.

. Some cities and local governments in Sacramento County collect additional local sales taxes which can be as high as 25. How much is county transfer tax in Sacramento County. This is the total of state county and city sales tax rates.

Property information and maps are available for review using the Parcel Viewer Application. Encino Los Angeles 9500. Method to calculate Sacramento sales tax in 2021.

View the E-Prop-Tax page for more information. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

The minimum combined 2022 sales tax rate for Sacramento County California is 775. How much is the documentary transfer tax. That means that while property tax rates in Fresno County are similar to those in the rest of the state property taxes paid.

Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. For tax rates in other cities see California sales taxes by city and county. 2020-2021 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171.

Under California law the government of Sacramento public schools and thousands of other special purpose districts are given authority to appraise housing market value fix tax rates and bill the tax. The December 2020 total local sales tax rate was also 8750. 075 lower than the maximum sales tax in CA.

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519 increase over last year.

Heres how Sacramento Countys maximum sales tax rate of 875 compares to other. 1788 rows Sacramento. The Sacramento sales tax rate is.

For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. A county-wide sales tax rate of 025 is applicable to localities in Sacramento County in addition to the 6 California sales tax.

To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. The average sales tax rate in California is 8551. Tax Rate Areas Sacramento County 2021 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900.

The sacramento sales tax rate is. Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca. Roseville California Sales Tax Rate 2021 The 775 sales tax rate in Roseville consists of 6 California state sales tax 025 Placer County sales tax 05 Roseville tax and 1 Special tax.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. The Sacramento County sales tax rate is 025. The California state sales tax rate is currently 6.

Cody Tromler November 24 2021 March 17 2022. The current total local sales tax rate in Sacramento CA is 8750. The median home value in Fresno County is 237500.

The sales tax jurisdiction name is Sacramento Tmd Zone 1 which may refer to a local government division. Using Zillow in San Carlos. This is the total of state and county sales tax rates.

The California sales tax rate is currently. The County sales tax rate is. The Sacramento County Sales Tax is 025.

You can print a 775 sales tax table here. T he tax rate is. Increase in Assessed Values for Sacramento County 519 532 539 Total Number of Secured Assessments 484604 Total Number of Unsecured Assessments 32803 Total Assessments 517407.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. Tax Collection and Licensing. UpNest June 5 2022.

Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. Payments may be made by mail or in person at the county tax collectors office located at 700 h street room 1710 sacramento ca 95814 between the hours of 8 am. The Sacramento County Sales.

Jurisdiction 2021-22 2020-21 Net Increase Increase. Sacramento property tax rate 2021. The Sacramento County sales tax rate is 025.

All are public governing bodies managed by elected or appointed officers. The December 2020 total local sales tax rate was also 7750. 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer.

Emerald Hills Redwood City 9875. The minimum combined 2022 sales tax rate for Sacramento California is. Historical Tax Rates in California Cities Counties.

775 Is this data incorrect The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

Cryptocurrency Taxes What To Know For 2021 Money

Women Make 3 Key Investing Mistakes Investing Start Investing Bond Funds

California Taxpayers Association California Tax Facts

Missouri Income Tax Rate And Brackets H R Block

Property Taxes Department Of Tax And Collections County Of Santa Clara

States With The Highest Property Taxes Gobankingrates

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

Housing In Infrastructure Bill Real Estate Agent And Sales In Pa Anthony Didonato Broomall Media Delaware Coun Infrastructure Sale House Real Estate News

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

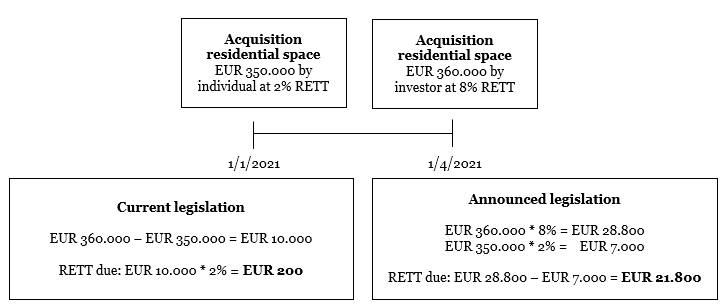

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp

What Is The Cost Of Tax Preparation In Sacramento Ca

Secured Property Taxes Treasurer Tax Collector

Nevada Vs California Taxes Explained Retirebetternow Com

The Most And Least Tax Friendly Major Cities In America

California Taxpayers Association California Tax Facts

Magnifying Glass In Front Of An Open Newspaper With Paper Houses Concept Of Rent Search Purchase R In 2021 Real Estate Investing Mortgage Interest Rates Real Estate